In the digital age, the security of our financial information is paramount, yet the threat of data breaches looms large. As we step into 2024, the alarming trend of leaked credit cards has become a topic of concern for consumers and financial institutions alike. With hackers constantly evolving their techniques, it’s crucial to understand how these leaks occur and what can be done to protect oneself from becoming a victim.

The phenomenon of leaked credit cards is not a new one, but the scale and sophistication of these breaches have increased dramatically. Reports suggest that thousands of credit card details could be in circulation, leading to potential financial ruin for unsuspecting victims. In this article, we will delve into the latest developments regarding leaked credit cards in 2024, examine how fraudsters exploit these leaks, and discuss preventive measures that individuals can take to safeguard their financial data.

As we navigate through this intricate landscape of cybersecurity, it’s essential to recognize the implications of these leaks not just on individuals, but also on the broader financial ecosystem. What does the rise in leaked credit cards mean for consumers, businesses, and regulatory bodies? Join us as we explore the answers to these pressing questions and equip ourselves with knowledge to combat this growing menace.

What Are Leaked Credit Cards?

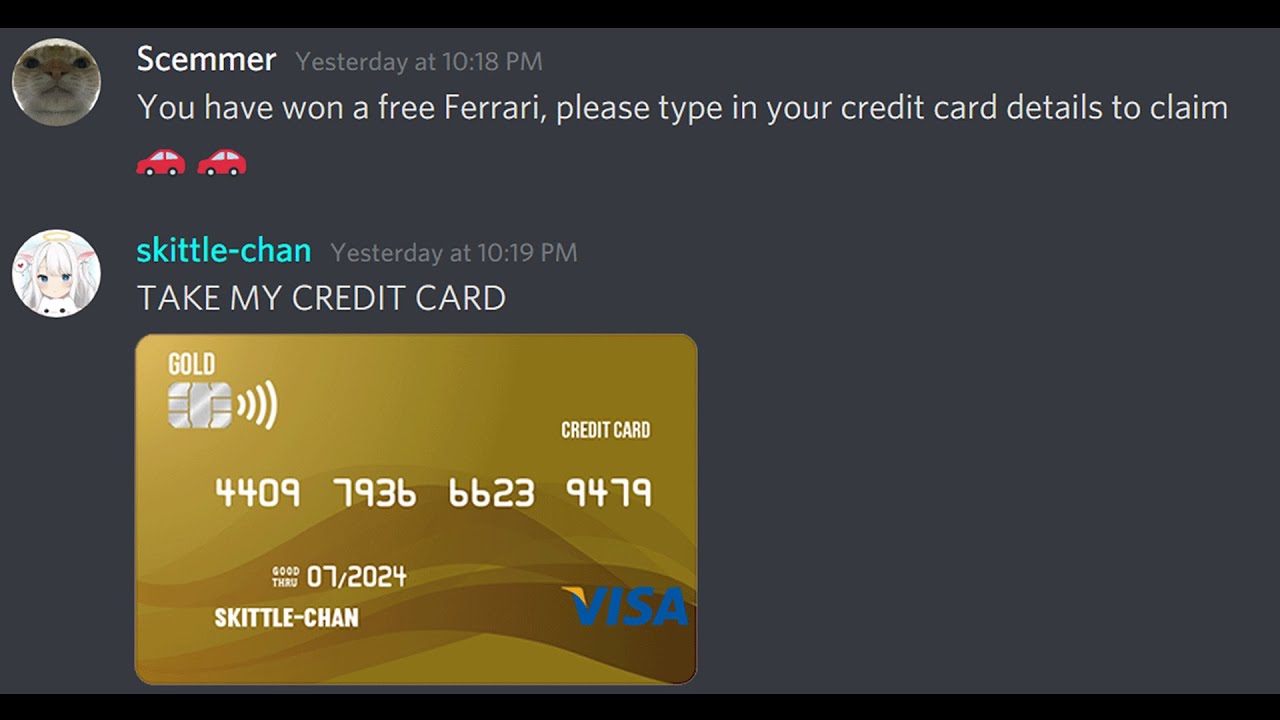

Leaked credit cards refer to instances where sensitive financial information, including credit card numbers, expiration dates, and CVVs, is exposed or made publicly available without consent. This information can be obtained through various means, such as data breaches, phishing attacks, or even the dark web. Once in the hands of cybercriminals, these details can be used for unauthorized transactions, leading to significant financial losses for victims.

How Do Credit Card Leaks Occur?

The methods by which credit card information is leaked are continually evolving. Some common ways include:

- Data Breaches: Large corporations or financial institutions may experience security breaches where sensitive customer data is stolen.

- Phishing Attacks: Fraudsters often use deceptive emails or messages to trick individuals into revealing their credit card information.

- Malware: Malicious software can infiltrate devices and collect personal information, including credit card details.

- Dark Web Sales: Stolen credit card information is frequently sold on the dark web, making it easily accessible to criminals.

Who Is Affected by Leaked Credit Cards?

Victims of leaked credit cards can range from everyday consumers to large corporations. Individuals who have their credit card information compromised may face financial hardships, including unauthorized charges and identity theft. Additionally, businesses that experience data breaches can suffer reputational damage and face legal repercussions.

What Are the Consequences of Leaked Credit Cards in 2024?

The consequences of leaked credit cards are far-reaching and can have lasting impacts on both individuals and organizations. Here are some potential repercussions:

- Financial Losses: Victims may face immediate financial losses due to fraudulent transactions.

- Credit Score Damage: Unauthorized charges can lead to unpaid debts, negatively affecting the victim's credit score.

- Legal Issues: Companies that fail to protect customer data may face lawsuits and penalties from regulatory bodies.

- Emotional Distress: The fear and anxiety associated with identity theft can take a toll on victims' mental health.

How to Protect Yourself from Leaked Credit Cards?

With the rising threat of leaked credit cards, it’s imperative to take proactive measures to protect your financial information. Consider the following tips:

- Use Strong Passwords: Create complex passwords for your online accounts and change them regularly.

- Monitor Your Accounts: Regularly check your bank statements and credit card transactions for any unauthorized charges.

- Enable Two-Factor Authentication: Add an extra layer of security to your accounts by enabling two-factor authentication.

- Be Cautious with Personal Information: Avoid sharing sensitive information over unsecured channels or with unknown sources.

What Should You Do If Your Credit Card Information Has Been Leaked?

If you suspect that your credit card information has been compromised, take immediate action:

- Contact Your Bank: Notify your bank or credit card provider to report unauthorized charges and freeze your account.

- Change Passwords: Update passwords for all online accounts associated with your financial information.

- Monitor Your Credit Report: Request a copy of your credit report and monitor it for any unusual activity.

- Consider Identity Theft Protection: Explore identity theft protection services that can help you mitigate risks.

What Role Do Financial Institutions Play in Preventing Leaked Credit Cards?

Financial institutions play a crucial role in safeguarding customers' financial information. They invest in advanced cybersecurity measures to protect against data breaches and implement strict protocols for monitoring transactions. Additionally, many institutions offer fraud detection services that alert customers to suspicious activity in real-time.

Are There Legal Consequences for Companies That Experience Data Breaches?

Yes, companies that fail to adequately protect customer data can face legal consequences. Regulatory bodies may impose fines and penalties, and affected individuals may file lawsuits seeking compensation for damages. Furthermore, businesses may suffer reputational harm, leading to a loss of customer trust and loyalty.

What Does the Future Hold for Credit Card Security?

As technology advances, so do the methods employed by cybercriminals. The future of credit card security will likely involve enhanced encryption techniques, biometric authentication, and the use of artificial intelligence to detect fraudulent activity. Consumers will need to remain vigilant and adapt to these changes to protect their financial information from leaks and breaches.

In conclusion, the issue of leaked credit cards in 2024 is a pressing concern for consumers and financial institutions alike. By understanding how these leaks occur and implementing preventative measures, individuals can better safeguard their financial information. As we move forward, collaboration between consumers, businesses, and regulatory entities will be essential in combating this ongoing threat.